Get instant verification results as clients complete their checks — no waiting or delays, with immediate confidence in client identity.

Automated ID document scanning and validation — passports, driver's licenses, and national IDs verified against official databases.

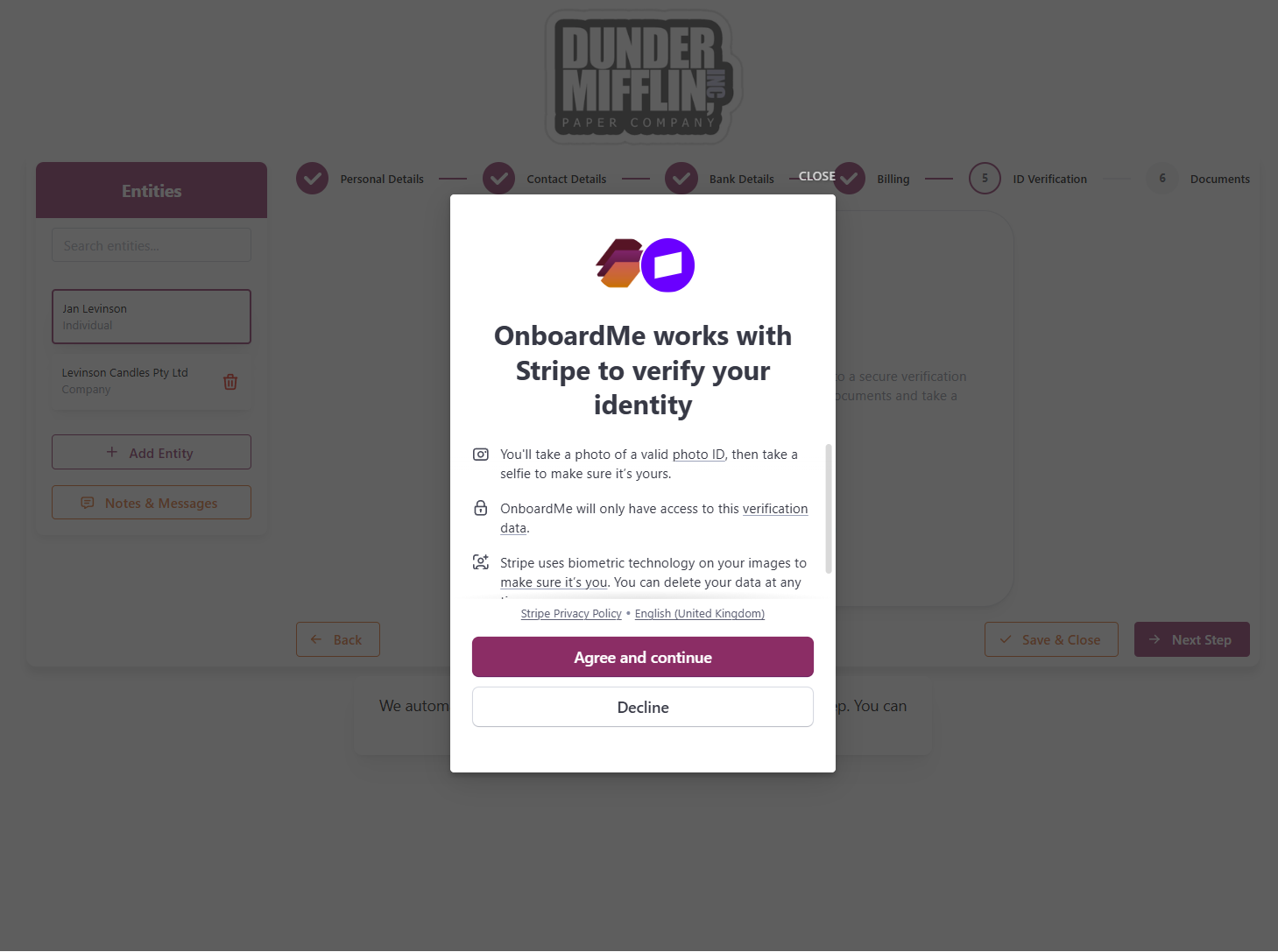

Face matching and liveness detection ensure the person submitting documents is who they claim to be — advanced security with a simple client experience.

Full audit trails, secure document storage, and detailed verification reports — everything you need to meet regulatory requirements.

White-labeled verification requests that reflect your brand — professional, secure, and easy for clients to complete.

Set up automated verification triggers — verify clients automatically when they're created, or schedule periodic re-verification checks.

We're expanding our compliance capabilities with automated Anti-Money Laundering (AML) and Politically Exposed Person (PEP) screening. These checks will run automatically alongside identity verification, giving you comprehensive risk assessment in one seamless workflow.

Monitor and manage all compliance checks from a centralised dashboard. Track verification status, review AML/PEP alerts, manage risk assessments, and maintain full compliance visibility across all your clients — all in one place.

Send identity verification requests independently — perfect for existing clients, periodic re-verification, or if you only need to verify identity without full onboarding.

Seamlessly integrated into your client onboarding workflow — alongside document collection, billing details, and entity setup in one unified journey.